In the merchant services industry, it is very common for processors to abuse and mislead business owners with bait-and-switch rates, hidden fees, and false advertising.

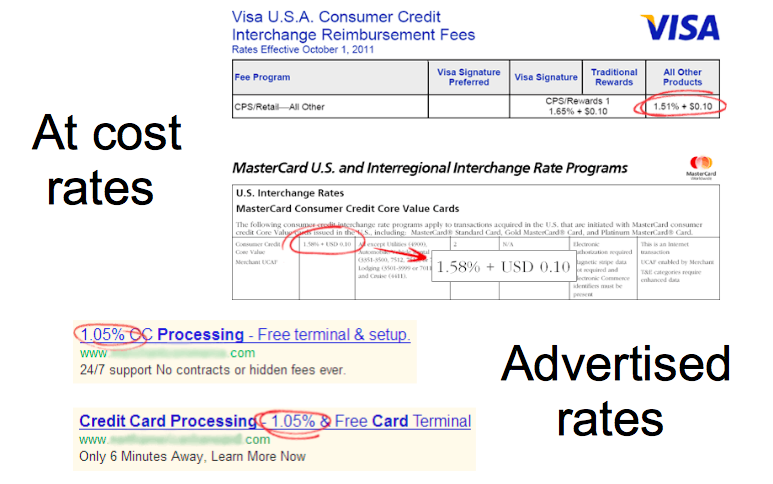

“Interchange” is a system used by all credit card processors to determine the cost of a transaction. Interchange fees go to the banks, not the processor, and they cover the cost of moving money. Because MasterCard and Visa publicize some of their interchange fees, we can actually expose advertised rates that are below cost – literally rates that are too good to be true.

Once a business is locked into a contract, these low fees are raised and businesses find themselves unduly indebted to their processor. Polaris Payments guards against such bait-and-switch by providing guaranteed rates. Your local agent monitors your statement to ensure that there are no hidden fees.

Our customized rate plans save you money by taking into consideration your existing ratios of debit cards, credit cards, rewards cards, and more. We work to find you a deal that is perfectly tailored to your unique business.